From 100% to 20%: The Game Theory Behind Polymarket's Fee Adjustment

From 100% to 20%: The Game Theory Behind Polymarket's Fee Adjustment

Let me first outline the recent timeline of Polymarket fee-related events.

Why Introduce Fees?

We all know Polymarket previously charged no fees for basic trading. So why introduce fees specifically for 15-minute cryptocurrency markets?

This requires understanding "latency arbitrage" bots.

In ultra-short-cycle markets like 15-minute intervals, outcomes are determined by prices from major exchanges.

Without fees, high-frequency trading bots exploit millisecond-level time differences to place orders on Polymarket before prices update.

Example

Current Polymarket 15-minute BTC UP (rise) probability: 90%. Suddenly, BTC price on exchanges drops 5%. Bots detect this immediately and buy cheap DOWN (fall) shares. After the bot's purchase, other bots and traders gradually buy in, raising the price. The original bot exits with profit.

Consequences

Market makers constantly get picked off by these high-frequency bots. Market makers naturally become reluctant to provide liquidity in these markets, ultimately degrading 15-minute crypto market liquidity.

The Solution

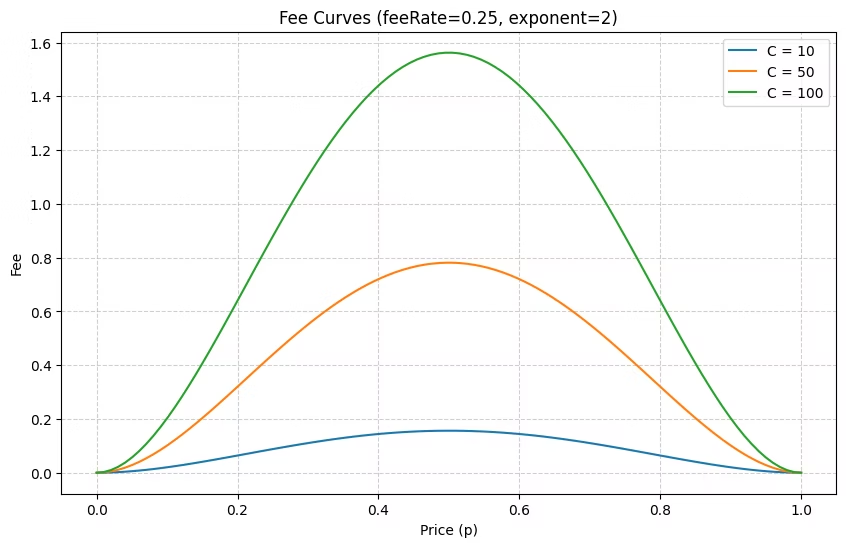

The platform introduced fees, especially highest at 50:50 odds. This directly makes many bot arbitrage costs exceed profits—these bots naturally shut down.

Why Subsidize Market Making?

As mentioned, market makers previously lost significant capital to predatory bots. To retain market makers, the platform shares fees with limit order placers (market makers).

Why did the rebate drop from 100% to 20%?

The key detail: "December 12-18, 20% fee rebate"—meaning the rebate after the 18th is TBD.

When fees first launched, market makers were uncertain whether they could fend off bots. The platform offered 100% fee rebates to cover their risk and retain liquidity.

Looking at the Data

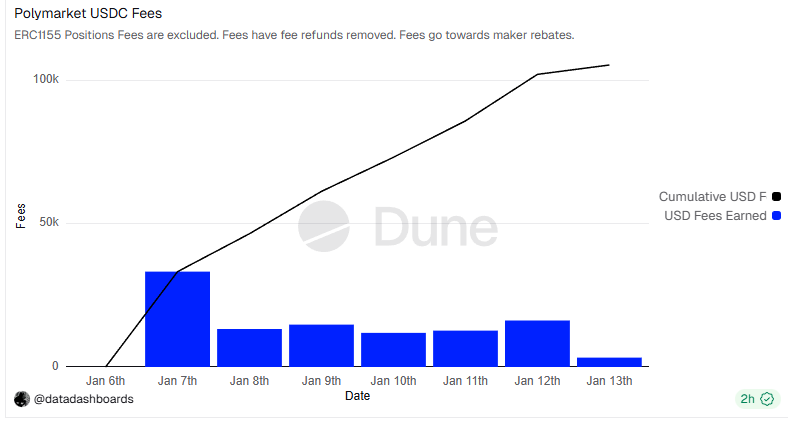

After fees launched, total fee volume dropped by half. This proves many high-frequency bots did shut down.

Seeing bots leave and market maker risk decrease, the platform decided 100% rebates might not be necessary anymore. They're testing 20% to observe the data.

This is why there's a one-week trial of 20% fee rebates—to see data performance before deciding future rebate rates.

Everything is about balancing interests among market makers, bots, and regular traders.

The "Money Printer" Bots

Polymarket has many markets with "money printer" bots. Few people truly understand how they work.

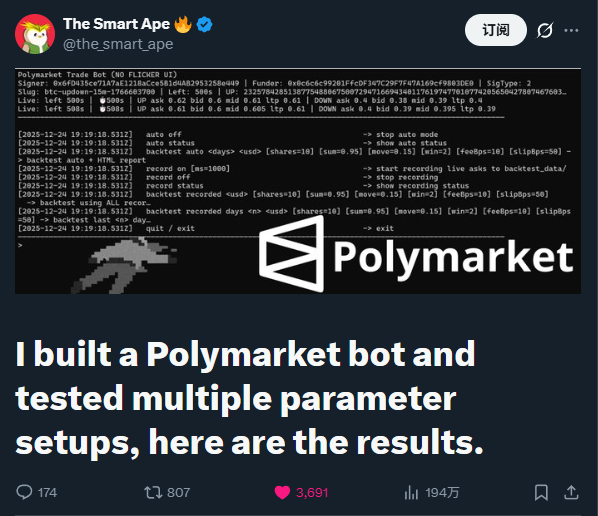

The most famous is probably a viral post on X with nearly 2 million views:

Many people tried the strategy and some actually profited.

But just days later, fees were introduced, and many couldn't profit anymore...

Have the "money printers" disappeared? No. If you're interested, you can study some consistently profitable accounts on Polymarket.

If you can reverse-engineer their strategies, your own "money printer" isn't far away. Just don't tell anyone else—but you can secretly tell me.

Conclusion

On Polymarket, with no third-party rake or fees (historically), we're all betting against each other. As a platform, their responsibility is providing a fair competitive environment for both sides.

Anyone who plays PvP games knows absolute fairness doesn't exist—you can only iterate version by version toward approximate fairness.

This also shows us that "money printers" do exist on Polymarket. The competition is all about technology and strategy.

Understanding the fee mechanism and its implications helps you navigate the platform more effectively and potentially identify opportunities others miss.