Can 6.9% Win Rate Be Profitable? Deconstructing the 0.1% Lottery Strategy

Can 6.9% Win Rate Be Profitable? Deconstructing the 0.1% Lottery Strategy

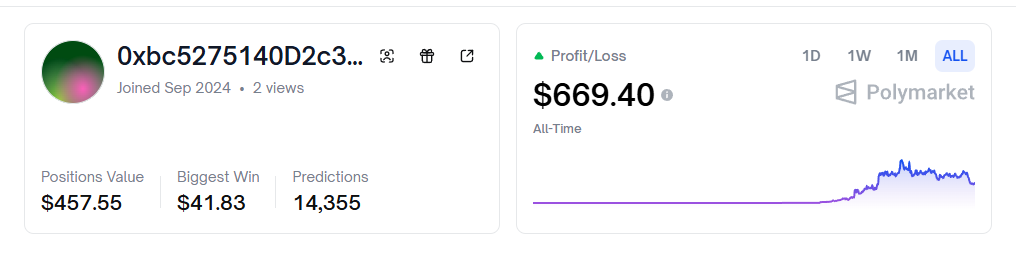

Today I'm sharing a trading bot strategy on Polymarket. Its current win rate is only 6.9%, with just $600+ in profits.

You might wonder: this person hasn't made much money and has a low win rate—why is it worth studying?

This strategy was discovered over a month ago, and returns have dropped significantly since. This article shares the learnable aspects of the strategy, not a recommendation to use it.

If you think these returns are too low and worthless, you can close this browser tab now. Disclaimer complete—let's dive in.

The 0xFFFFFFF Trader

In November last year, someone shared this trader's information on X.

At the time, 0xFFFFFFF still had a username. Later, they deleted it. Why? Because the strategy is so simple that anyone could analyze it from their trading history.

Too many people checked their records, imitated, and analyzed—diluting their returns.

Not wanting further dilution, they changed their name. Searching for 0xFFFFFFF now yields nothing.

The 0.1% Strategy

0xFFFFFFF's strategy summarized in one sentence: Bet on 0.1% probability outcomes.

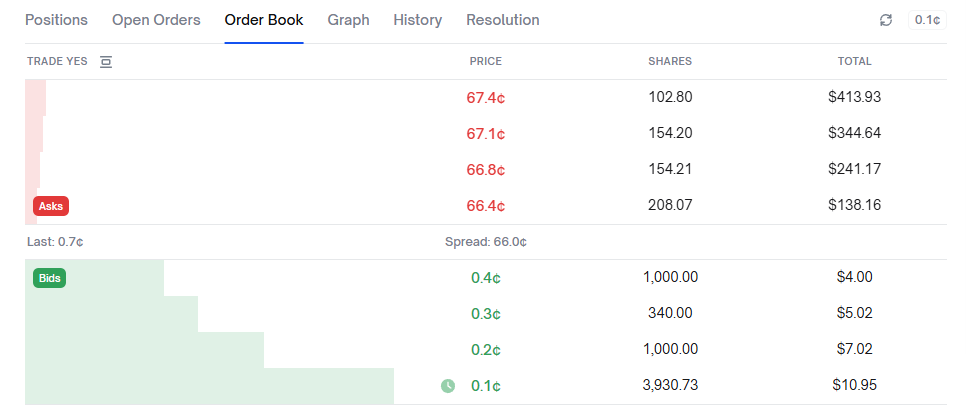

We know Polymarket prices represent probabilities. Some markets have minimum prices at 1%, others at 0.1% (approximately $0.001 per share).

0xFFFFFFF mass-places orders to buy 0.1% shares. This is the opposite of the "buy 99%" tail strategy many KOLs share—though this is also a tail strategy, we typically call it the lottery ticket strategy.

You spend very little money for a chance at a big win. The odds are slim, but the cost is minimal.

- 99% probability: 10 shares = $9.90

- 0.1% probability: 10 shares = $0.01

You must be wondering: can such low probability actually be profitable?

The Statistics

Strategies are built on data-driven conclusions. Let's backtest with actual historical data.

I prepared ~160,000 Polymarket trading records from the past two years. Due to varying start/end times and missing crypto market history, data completeness isn't perfect.

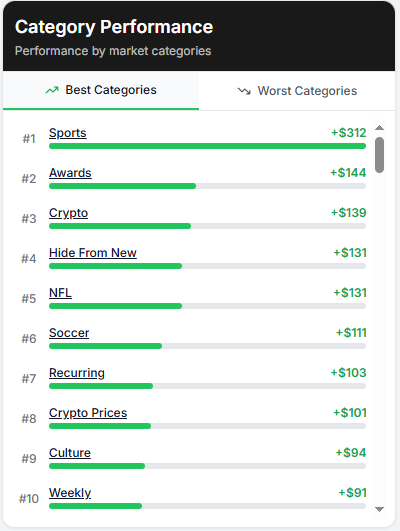

Simulation: Buy the 0.001 price side of every market, categorized by tag, and check win rates.

Results:

| Tag | Trades | Wins | Win% | | --- | --- | --- | --- | | Sports | 20,554 | 58 | 0.28% | | Recurring | 17,295 | 37 | 0.21% | | Games | 15,176 | 42 | 0.28% | | Crypto | 14,768 | 24 | 0.16% | | Politics | 8,004 | 24 | 0.30% | | Weather | 3,847 | 19 | 0.49% | | Soccer | 3,582 | 14 | 0.39% | | Trump | 3,483 | 11 | 0.32% | | Esports | 2,997 | 8 | 0.27% | | NBA | 2,818 | 7 | 0.25% |

Categories exceeding 0.1% actual win rate can theoretically generate positive expected value.

If actual hit rate consistently exceeds implied probability (price), and trades keep executing, expected value is theoretically positive. But reality is constrained by execution and capital lockup periods.

Comparing with 0xFFFFFFF's Polymarket Analytics stats:

Sports is indeed the highest-return category—high volume and high win rate.

We can roughly reconstruct 0xFFFFFFF's operation: find high win-rate tag markets, place low-price limit orders, fixed quantity, no selling—hold until settlement.

Harsh Reality

They say ideals are beautiful but reality is harsh. Here's 0xFFFFFFF's profit curve as of this writing:

When exposed in late November, profits were $1,000+. Now only $600+ remains—significant drawdown.

After researching this strategy, I made some optimizations and tested with small real capital. Results: basically no profit either.

My analysis of why:

- Strategy exposure led to competition

- Market efficiency improved

- Execution challenges

The 14 x 0.001 = 0.01 Trick

Browsing 0xFFFFFFF's trading history, you'll notice many 14-share transactions. I wondered: what does 14 mean?

Opening the trading interface and entering different quantities at 0.1% price:

- 14 shares at 0.1% = $0.01

- 15 shares at 0.1% = $0.02

Why does 1 share difference double the price?

Initially I thought it was a UI rounding display issue. But actual transactions matched the UI exactly!

Is this a bug? Not really.

Polymarket's system rounds the actual USDC amount (size x price) to 2 decimal places.

0xFFFFFFF buys 14 shares for $0.01 each time—essentially getting 4 extra shares free, significantly boosting final profits!

This trick is probably unknown to most people since few use 0.1% strategies.

Conclusion

Don't think you can profit big just by seeing a strategy on Twitter. As one trader wisely noted:

Strategies shared publicly tend to stop working, and no strategy makes everyone money.

Many profitable traders keep their strategies secret. Once shared, they often fail.

0xFFFFFFF's strategy has significant optimization potential:

- You don't have to hold until settlement—exit when profit seems sufficient

- You don't have to target exactly 0.1%—what about 0.2%?

Today we learned not just about the "lottery ticket strategy" but also that the system rounds amounts exceeding two decimal places.

While the strategy may not be effective anymore, these insights are worth learning and thinking about.