Where Do Polymarket Shares Come From? Understanding Split and Merge

Where Do Polymarket Shares Come From? Understanding Split and Merge

In the previous article, we discussed YES + NO = 1, like a dollar bill torn in half. But here's a question many haven't considered: Who tears this dollar apart? Is it the platform?

Many people wonder: when a new market opens with no trades yet, how is pricing determined? Is there an opportunity to grab cheap shares at market open?

This brings us to two new concepts: Split and Merge.

The "Money Printer": Split

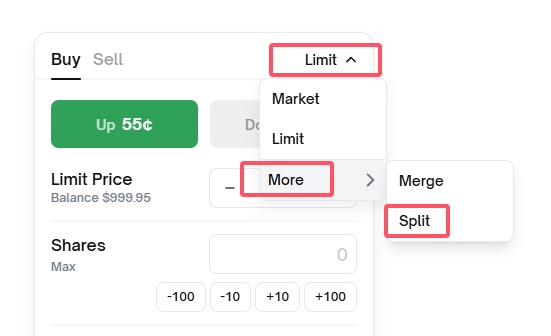

In a small corner of Polymarket's order interface, there's an option many people overlook:

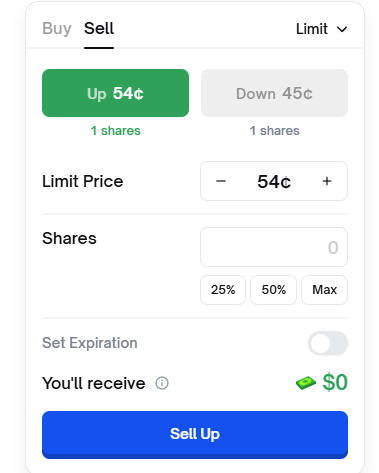

Click it, enter 1, then click "Split shares" to perform the money-printing operation. After wallet signature, you'll see in the Sell tab:

You now have 1 share each of UP (YES) and DOWN (NO)!

Do you now have a deeper understanding of YES + NO = 1?

This is Polymarket's split operation. Simply put: you can split $1 into two vouchers at any time in any market—one YES and one NO.

So who tears the dollar apart? Anyone can.

When a new market opens, we can use split to obtain YES and NO shares, then freely price them. This is the source of market shares at launch.

Split Use Cases

When you need many shares but market liquidity is insufficient, you can accumulate shares through splitting.

For example, when a hot market has YES prices driven up by buyers, but you're bearish on YES and the NO order book depth is insufficient—you can print your own shares, sell the overpriced YES, and keep the NO shares waiting for prices to normalize.

The "Shredder": Merge

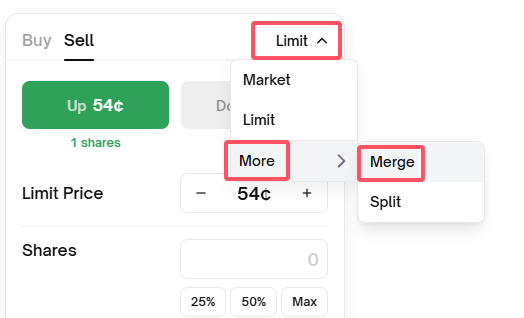

Now let's try the merge operation:

Enter 1, click "Merge Shares," sign with your wallet, and the two vouchers are combined. The torn $1 returns, and your YES and NO shares disappear.

The merge operation is like a shredder—it destroys YES and NO, returning $1 to you.

Many people think after buying YES, they can only wait for settlement or sell the YES. Merge provides a third option: buy NO to combine with your YES and convert directly to dollars without waiting for settlement.

High-Frequency Trading Example

In high-frequency market making, you might buy YES at 0.3, and within 1 second the price jumps to 0.8. The market maker feels the risk is too high and wants to exit, but it's only been 1 second.

Polymarket uses off-chain matching with on-chain settlement—it takes about 5 seconds (sometimes longer during network congestion) to see your position.

If the market maker sees NO selling at 0.24, they can immediately buy NO at 0.24. Now they hold:

- YES (cost 0.3) + NO (cost 0.24)

Merge them into $1.

Total cost: 0.54, Return: $1, Net profit: $0.46

No need to wait for YES to arrive on-chain—exit within seconds by merging. This is a common technique for high-frequency market makers and bots to lock in profits quickly during high volatility.

The Market Maker's Way of Life

Regular users rarely use split and merge, but market makers use them daily.

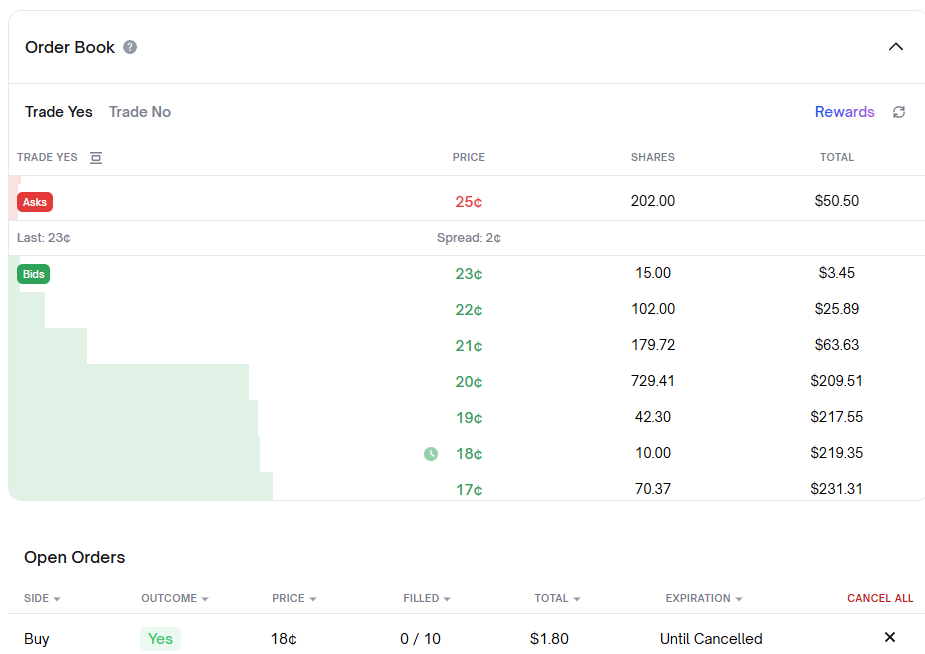

In high-liquidity, high-volume markets, bid might be 0.50 and ask 0.51—almost no spread.

But in inactive markets:

You might see bid at 0.23 and ask at 0.25—a noticeable spread. In many inactive markets, this spread is often much larger.

For example:

- YES ask: 0.6

- NO ask: 0.6

- Total: 0.6 + 0.6 = 1.2 > 1

This means if you market-buy both YES and NO right now, you'd spend $1.20 to collect $1.

This is exactly where Split shines in inactive, shallow, wide-spread markets.

You can:

- Split $1 into 1 YES + 1 NO

- List YES at 0.59, list NO at 0.59

- If both fill: 0.59 + 0.59 = $1.18

- Profit: 1.18 - 1 = $0.18

This is what market makers do daily. When markets lack liquidity and spreads are wide, they generate shares through splitting, provide liquidity through limit orders, and earn the bid-ask spread.

Sometimes market makers accumulate large YES or NO positions due to one-sided price action. When liquidity doesn't support their exit, they buy the other side and Merge.

Liquidity Rewards

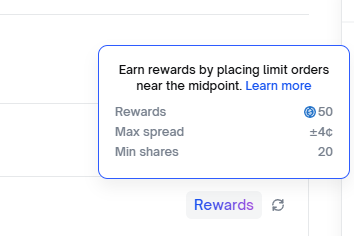

Additionally, providing liquidity earns rewards in some markets:

For example, placing orders within 4 ticks of the spread, minimum 20 shares, qualifies you to share a $50 reward pool.

Early liquidity rewards were much higher but have decreased significantly. Check the official liquidity rewards dashboard at: https://polymarket.com/rewards?via=simor-wang

Note: Market makers have many strategies—this is just an example, not necessarily optimal. Market makers' biggest fear is informed traders who often cause devastating losses. Professional market makers have sensitive decision systems that cancel all orders immediately when detecting one-sided momentum.

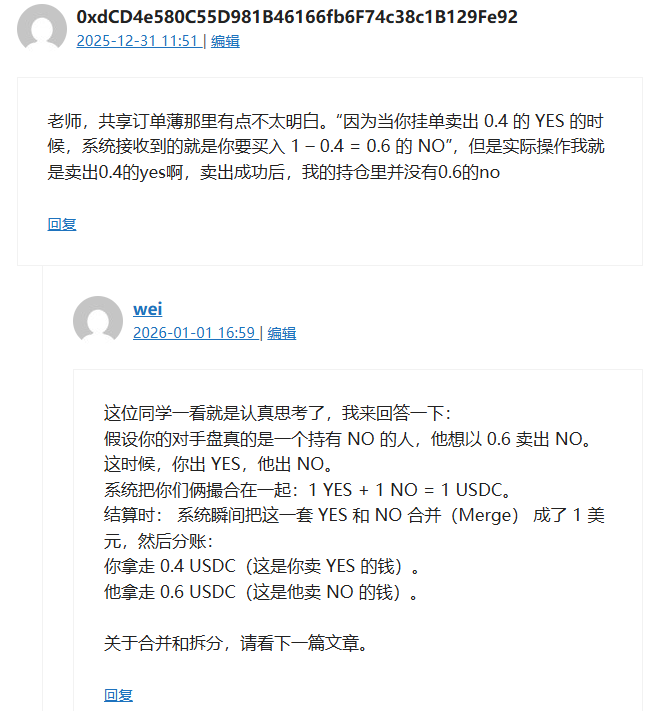

Q&A

This reader's question should be fully answered after reading this article. It's an excellent question worth sharing.

Conclusion

Split and Merge seem like simple features, but they represent two trading mindsets:

Regular traders focus on price movements, choosing between YES and NO.

Advanced players study liquidity—using split to generate shares for spread capture, using merge to optimize exit paths.

When trading, think from multiple angles—you might discover more opportunities.

After understanding YES + NO = 1 from the previous article, this article should give you deeper appreciation for the elegant design of split and merge. Understanding these mechanisms is essential for anyone serious about trading on Polymarket.