Reverse Engineering Polymarket Strategies: Extracting Trading Models from On-Chain Data

Reverse Engineering Polymarket Strategies: Extracting Trading Models from On-Chain Data

Recently on X, I've seen many people sharing various Polymarket trading strategies from top traders—some at the top of leaderboards, others with impressive win rates and returns.

We can usually see what they bought, but it's hard to deduce their actual trading strategy.

Many people like to copy-trade, but copy-trading risks often outweigh benefits. Teaching someone to fish is better than giving them fish—understanding their trading logic is key.

Today I'll teach you how to easily find smart traders' trading records and study their strategies.

Finding Your Targets

First, we need addresses of smart traders—those with positive returns, high win rates, or high profits on Polymarket. Everyone has different methods for finding these.

Polymarket Analytics

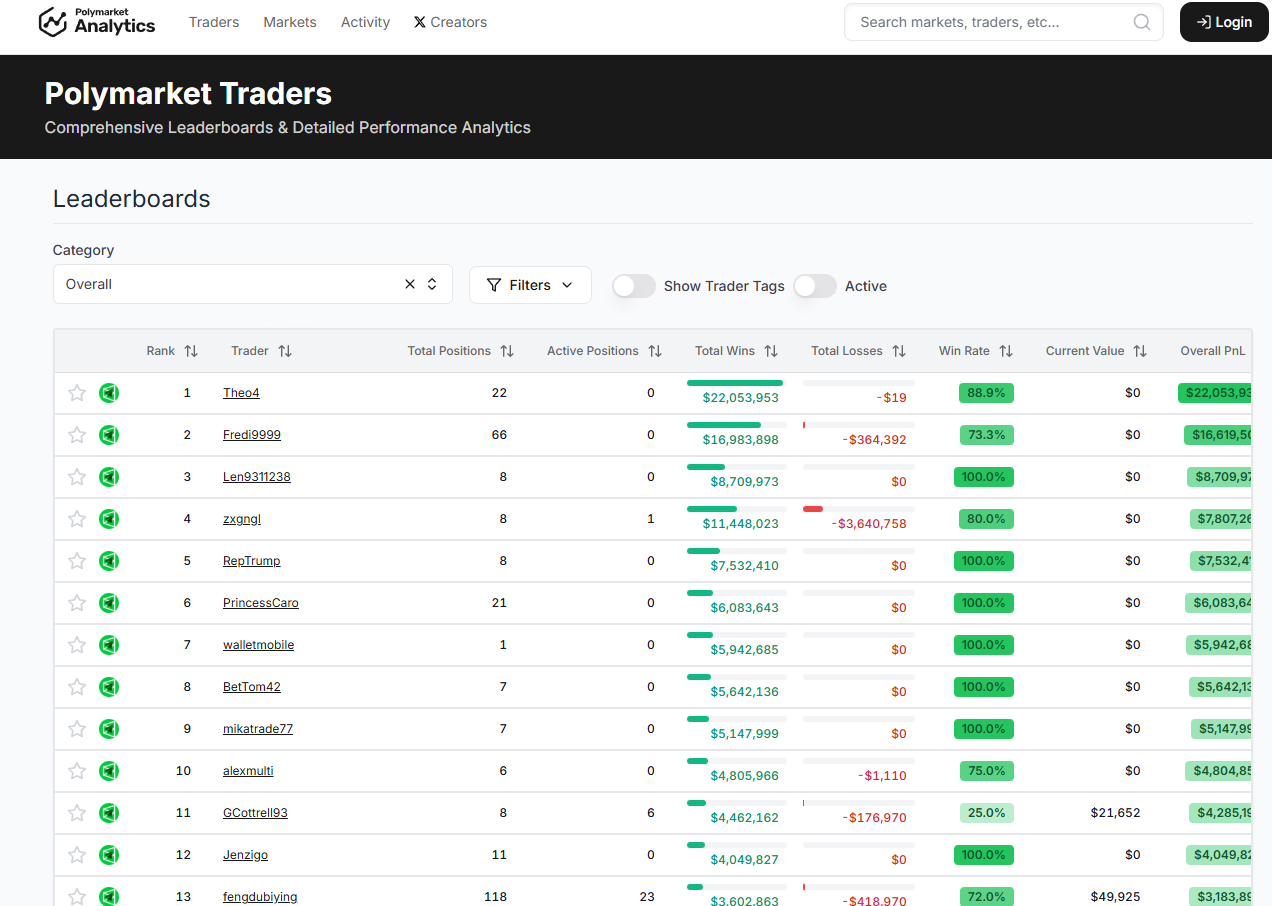

Polymarket Analytics is a powerful analysis website with extensive data.

Visit: https://polymarketanalytics.com/traders

You'll see many top traders—the highest has earned over $20 million.

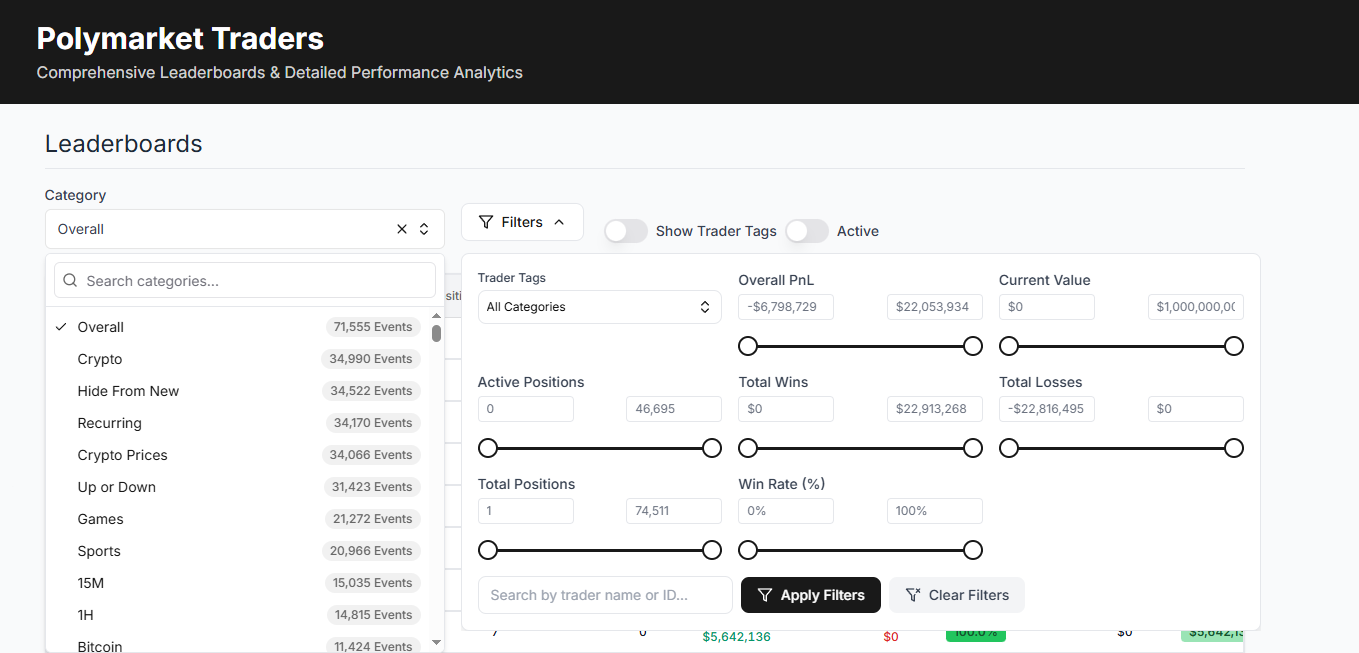

The leaderboard offers many filters: tags (sports, crypto, games, etc.), trade count, volume, profit, win rate, and more.

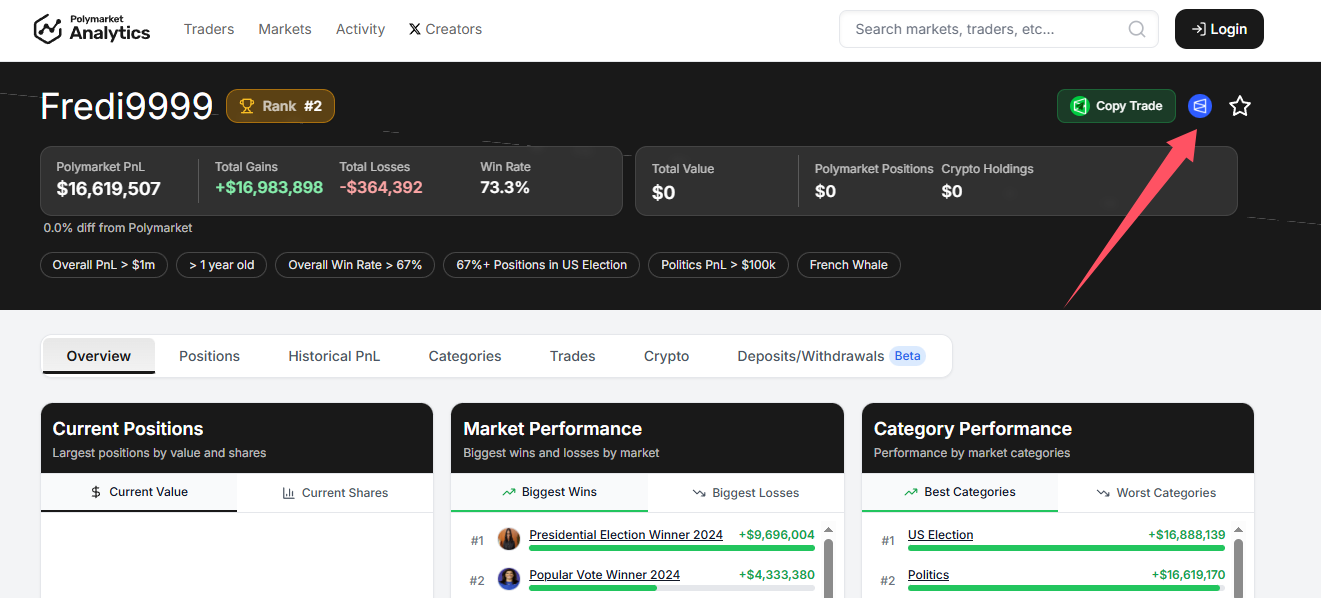

Filter by your criteria, find interesting traders, and click their profile:

This takes you to their Polymarket page. Save this link—we'll need it later.

X Platform (Twitter)

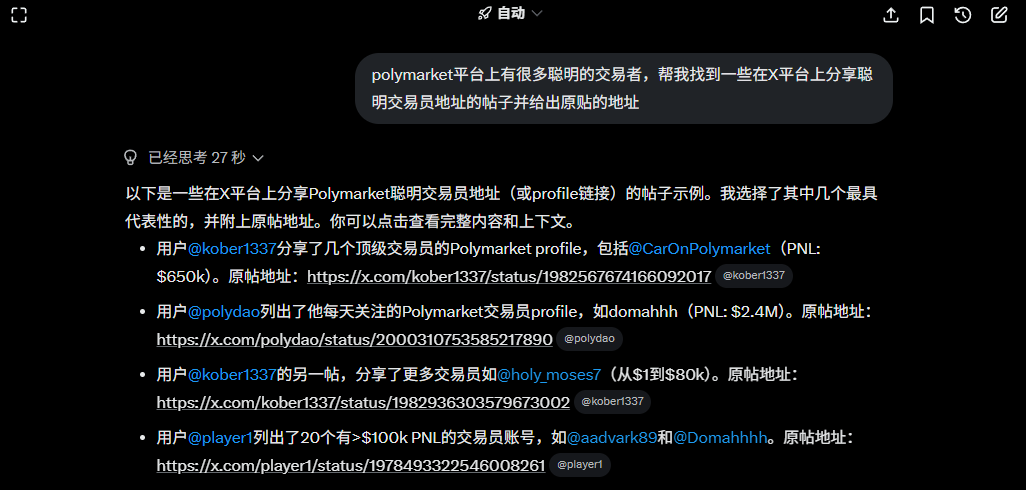

Many people share on X. Don't just use the search bar—keywords are tricky.

The best helper for finding X content is Grok. It can find exactly what you want:

Click any post and you'll find many trading links:

Customize your search—crypto 15-minute markets, NBA, etc. Use my prompt as inspiration, not a rigid template.

Specific Markets

If you focus on specific trading areas, check "Top Holders" below any market:

Many traders worth investigating here.

These are my common methods—mainly to inspire your thinking. Many more approaches exist.

Gathering Intelligence

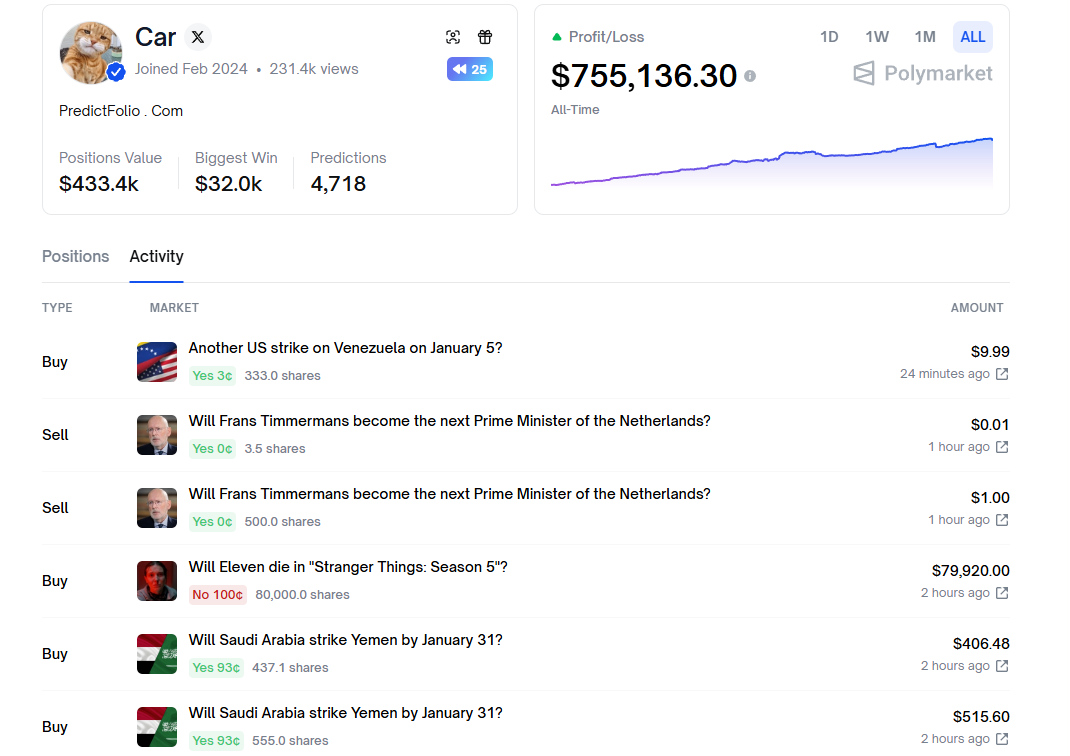

Now we have an address like: https://polymarket.com/@Car

What's next?

With a target, we need their intelligence (trading records) for analysis.

The Activity tab shows recent trading records, sometimes from just minutes ago.

For programmers, you can monitor browser requests and write a scraping script.

For non-programmers, AI can write the script, though it's a bit troublesome. I've created a simple tool:

Only requires the link address and maximum record count.

After collection, you'll download a file like: polymarket_0x7c3d_1500.json

Open this JSON in a text editor to see the collected trading records.

AI Investigation

We have a bunch of incomprehensible data. Don't panic—let AI help us reconstruct the trading process from this intelligence.

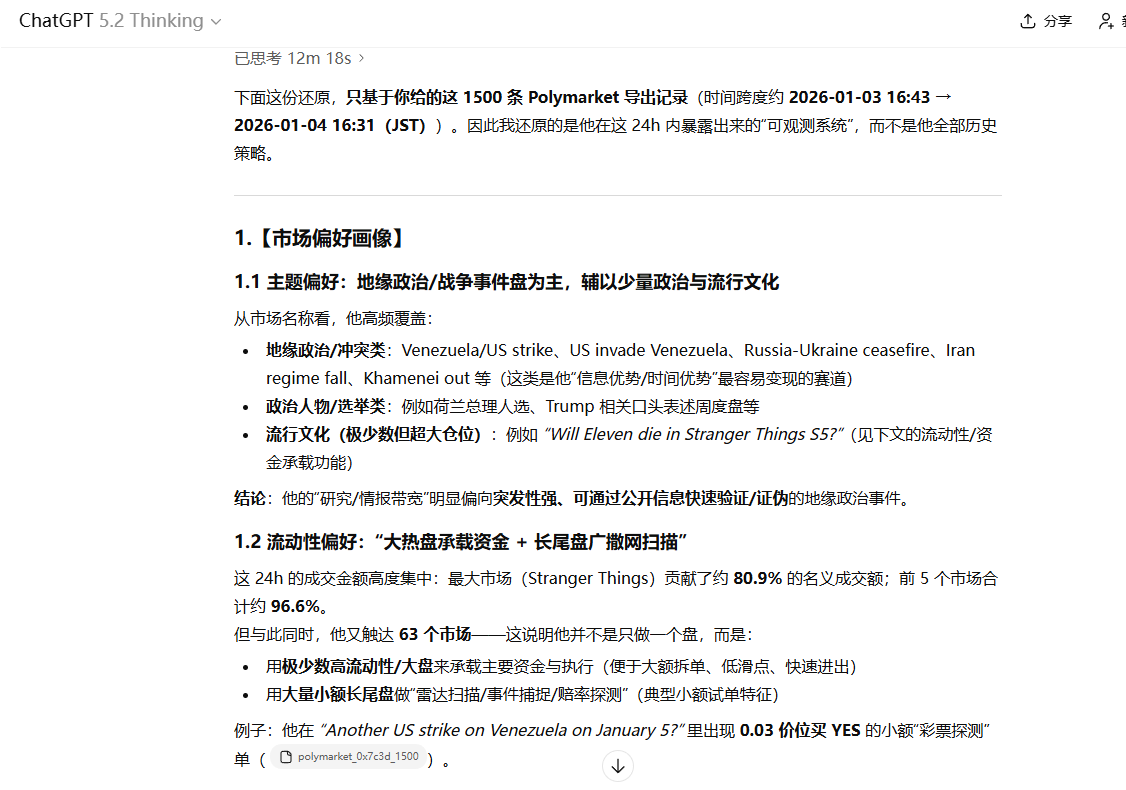

Take your trading record file to ChatGPT, DeepSeek, Gemini, or Grok—any that supports JSON file uploads.

Then use a detailed prompt asking AI to analyze:

- Market preference profile

- Entry/exit logic

- Risk control model

- Special behavior patterns

Wait for AI analysis. Depending on JSON file size, thinking time varies—larger files take longer, usually several minutes. You can use different AIs simultaneously for more scientific comparison.

My prompt isn't perfect—it's customized for my needs. Customize yours based on your requirements.

Give AI the JSON trading data and ask it to generate a prompt for your specific analysis needs. The best prompt is one suited to you.

Conclusion

I hope everyone finds traders worth learning from, learns something from them, then surpasses (outcompetes) them.

Of course, you must understand YES + NO = 1 before studying strategies—review my previous articles for this foundation.

Note that AI may not fully understand their strategy—it's directional reference only. You can only see final on-chain transactions, not off-chain order book data (only the trader sees that). So it's fundamentally impossible to completely understand their strategy.

Many smart traders today have unique trading methods. Through this article, you can easily identify whether someone trades manually or algorithmically—very helpful for your own trading.

Understanding how to analyze other traders' strategies is a powerful skill that can accelerate your learning curve on Polymarket.